Analysing India’s EV Market (2022-2024) using Power BI

In the ever-changing scenario of the automotive industry, electric cars have been the ray of hop for innovation and eco-friendliness. USA-based leading player in the EV space, AtliQ Motors, has experienced an unprecedented boost in its share of the electric and hybrid car market in North America over the last five years, gaining a 25% share in this market. As a part of their strategic growth, AtliQ moors looked towards the fast-growing Indian market, where they have less than 2% share currently. This blog article explores data-driven path that AtliQ motors followed to learn the Indian EV market and create a path for a successful entry.

The Challenge: Navigating the Indian EV Market

AtliQ Motors had a tough task ahead them: familiarizing themselves with the intricacies of the Indian EV market, which is yet to develop fully in comparison to North America. The responsibility was left to the data analytics department. The aim was to perform an extensive market analysis to pinpoint possible opportunities and challenges in entering AtliQ’s top-selling EV models into India.

Dashboard Overview:

To facilitate the analysis, I have developed an insightful Power BI dashboard. This dashboard provides a detailed overview of the EV market in India, focusing on sales trends, market penetration, and growth projections.

1] Exclusive Summary:

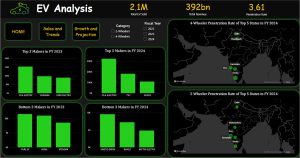

The figure 1 gives us the overview of the sales, revenue, top states, top and bottom makers.

Fig 1. Exclusive Summary

Fig 1. Exclusive Summary

- Total EV sold: The dashboard highlights that a total of 2.1 million EVs have been sold, generating a revenue of 392 billion INR.

- Penetration Rate: The current penetration rate is 3.61%, indicating significant room for growth.

- Top 3 Makers in FY 2023: OLA Electric leads the market, followed by Okinawa and Hero Electric. This trend continues in FY 2024, with OLA Electric maintaining its top position, followed by TVS and Ather.

- Bottom 3 Markers in FY 2023: PURE EV, Being and Jitendra are at the lower end of the spectrum. In FY 2024, Kinetic Green, Revolt and BattRE Electric occupy these positions.

- 4-wheeler Penetration Rate: Delhi, Chandigarh, Karnataka, kerala and Goa are the top 5 states with the highest penetration rates for 4-wheelers.

- 2-wheelers Penetration Rate: Delhi, Maharashtra, Karnataka, Kerala and Goa, show high penetration rates for 2-wheelers.

2] Sales and Trends:

The figure 2. Shows the monthly and quarter wise sales and trends.

Fig. 2 Sales and Trends

- Peak Month: March is the highest-selling month, indicating strong year-end sales momentum.

- Low Month: May records the lowest sales, possibly due to seasonal factors affecting consumer demands.

- 2-wheeler segment:

- Top performers: OLA Electric (489.5K), TVS (272.6K) and Ather (204.4K) lead the market.

- Growth Trends: OLA Electric shows the most significant upward trend in quarterly sales, followed by TVS and Ather, indicating increased customer trust and market expansion.

- 4-wheeler segment:

- Leading Brands: Tata Motors dominates, with Mahindra & Mahindra and MG Motor competing closely.

- Growth Trends: Tata Motors exhibits significant sales growth quarter-over-quarter, reinforcing its dominance in India’s EV space.

3] Growth and Projection:

The figure 3 shows the CAGR (compound Annual Growth Rate), Projected sales in 2030, Revenue growth rate of 2-wheeler and 4-wheeler.

Fig. 3 Growth and Projection

- Top 5 4-wheeler makers by CAGR:

- Volvo Auto India leads with the highest CARG, indicating strong expansion in the Indian market.

- BMW India and Mercedes-Benz AG follows, showing steady growth, suggesting increasing consumer interest in premium EVs.

- BYD India and MG Motor display slower growth, highlighting room for improvements.

- 2-wheeler Revenue Growth Trend:

- Mizoram leads with the highest revenue growth in the 2022-2024 period, showing a surge in 2-wheeler EV adoption.

- States like Meghalaya, Daman & Diu, Puducherry, and Goa also demonstrate high growth, suggesting an increasing preference for EVs in smaller regions.

- Several major states, including Maharashtra, Tamil Nadu, and Karnataka, show steady revenue growth, indicating a strong market foundation.

- 4-wheeler Revenue Growth Trend:

- Manipur and Arunachal Pradesh exhibit exponential growth, exceeding 1000% revenue, suggesting emerging markets for 4-wheeler EVs.

- UP, Bihar and Chhattisgarh also show significant growth hinting at a rising demand for EV cars.

- Mature markets like Karnataka, Maharashtra and Gujarat display more stable but slower growth compared to emerging states.

- Projected EV Sales by 2023:

- Karnataka is projected to lead in EV adoption with Maharashtra and Kerala following closely.

- Tamil Nadu, Goa and Rajasthan are also expected to see significant sales growth.

- Delhi, Chandigarh, and Odisha are among the top 10, reinforcing their early EV adoption strategies.

Conclusion

AltiQ Motors journey into the Indian EV market requires a well-planned, data-driven approach. The insights derived from the Power BI dashboard highlights key trends, challenges and opportunities for successful market entry.

- Market Potential: With 2.1 million EVs sold and a penetration rate of 3.61%, India presents huge growth potential, particularly in 2-Wheeler and premium 4-Wheeler segments.

- Competitive Landscape: Ola Electric, Tata Motors, and Ather are leading the market, making it essential for AtliQ to develop a unique value proposition.

- Emerging Markets: States like Manipur, Arunachal Pradesh and Mizoram are showing exponential growth, signaling potential untapped demand.

- Strategic Entry Points: Focusing on premium EVs and mid-range segments, along with leveraging demand in high-growth states, will be crucial for AtilQ’s expansion.

Strategic Recommendations:

- Innovative Product Launches: Introduce top-selling EV models with features tailored to Indian consumer’s preferences and needs/

- Targeted Marketing: Focus marketing efforts on high-penetration states and emerging markets to build brand awareness and drive sales.

- Partnerships and collaborations: Form strategic partnership with local dealerships, charging infrastructure providers and government bodies to facilitate market entry and expansion.

- Customer Education: Invest in consumer education initiatives to highlight the benefits of EVs and build trust among potential buyers.

- Monitoring and Adaptation: Continuously monitor market trends and consumer feedback to adapt strategies and stay ahead of competitors.

By following this data-driven approach, AtliQ Motors can navigate the complexities of the Indian EV market, overcome challenges and establish a strong foothold. The insights from Power BI dashboard server as a valuable tool in crafting a successful market entry strategy and driving sustainable growth in one of the world’s fastest-growing EV markets.

Credits: Dataset and problem statement taken from codebasics.io.